If a company uses variable costing for internal reporting, they would still need to prepare external financial statements using absorption costing to comply with tax regulations. Variable costing is a way of allocating expenses between fixed and variable costs. Absorption costing is also often used for internal decision-making purposes, such as determining the selling price of a product or deciding whether to continue producing a particular product. The manufacturer should accept the special order based on their variable costing method. Variable costing, also known as marginal costing, is mainly used for internal reporting. Whereas, full costing, also known as absorption costing, is mainly for external reports.

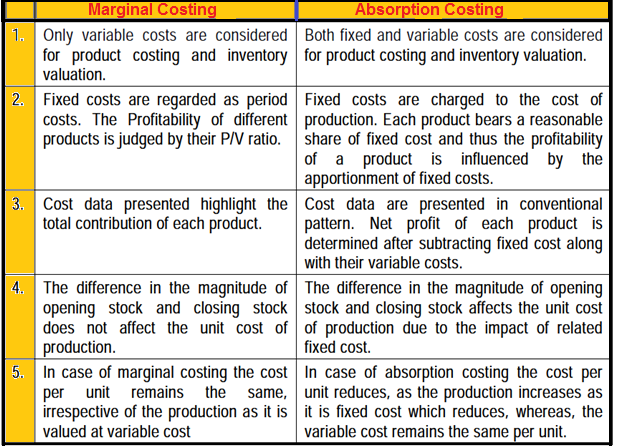

Key Differences

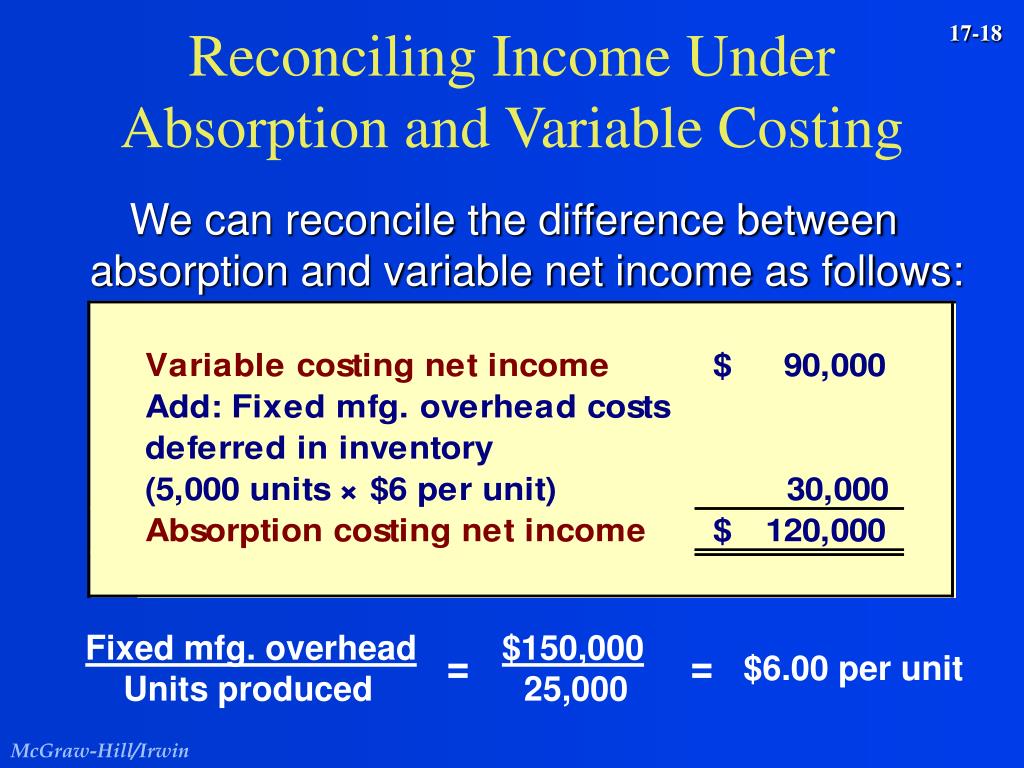

The main difference between absorption and variable cost of production is in the treatment of fixed costs. The difference between absorption costing and variable costing can have a significant impact on manufacturing decision-making. For example, absorption costing typically shows a higher profit margin than variable costing when production volume is high and a lower profit margin when production volume is low. If you’re selling products or services at a loss, absorption costing can help you determine how much each unit costs you to produce.

Inventory Differences

- In the previous example, the fixed overhead cost per unit is \(\$1.20\) based on an activity of \(10,000\) units.

- Absorption costing information may not always provide the best signals about how to price a product, reach conclusions about discontinuing a product, and so forth.

- Thus a brief explanation of variable costing and the difference between it and full costing.

If the entire finished goods inventory is sold, the income is the same for both the absorption and variable cost methods. The difference is that the absorption cost method includes fixed overhead as part of the cost of goods sold, while the variable cost method includes it as an administrative cost, as shown in Figure 6.12. It is anticipated that the units that were carried over will be sold in the next period. If the units are not sold, the costs will continue to be included in the costs of producing the units until they are sold. This treatment is based on the expense recognition principle, which is one of the cornerstones of accrual accounting and is why the absorption method follows GAAP.

Cost Accounting for Ethical Business Managers

It does not include a portion of fixed overhead costs that remains in inventory and is not expensed, as in absorption costing. Finally, remember that the difference between the absorption costing and variable costing methods is solely in the treatment of fixed manufacturing overhead costs and income statement presentation. Regarding selling and administrative expenses, the only difference is their placement on the income statement and the segregation of variable and fixed selling and administrative expenses. Variable selling and administrative expenses are not part of product cost under either method.

The advantages of variable costing

For example, if a fixed cost of $1,000 is allocated to 500 units, the cost is $2 per unit. While this was not the only reason for manufacturing too many cars, it kept the period costs hidden among the manufacturing costs. Using variable costing would have kept the costs separate and led to different decisions. With variable q4dq why are sunk costs irrelevant costing, all variable costs are subtracted from sales to arrive at the contribution margin. The variable product costs include all variable manufacturing costs (direct materials, direct labor, and variable manufacturing overhead). These costs are subtracted from sales to produce the variable manufacturing margin.

Interest in getting savvy tips for improving your business efficiency?

Variable costing includes only variable manufacturing costs in the cost of goods sold, and fixed manufacturing costs are expensed as incurred. Indirect costs are those costs that cannot be directly traced to a specific product or service. These costs are also known as overhead expenses and include things like utilities, rent, and insurance.

On the other hand, variable costing treats fixed manufacturing overhead costs as period expenses. These costs are not allocated to units of production but are expensed in the period they are incurred. Consequently, variable costing only includes variable manufacturing costs in the cost of each unit produced. This approach can result in lower per-unit costs compared to absorption costing. Outdoor Nation, a manufacturer of residential, tabletop propane heaters, wants to determine whether absorption costing or variable costing is better for internal decision-making.

Finally, remember that the difference between theabsorption costing and variable costing methods is solely in thetreatment of fixed manufacturing overhead costs and incomestatement presentation. Regarding selling andadministrative expenses, the only difference is their placement onthe income statement and the segregation of variable and fixedselling and administrative expenses. Variable selling andadministrative expenses are not part of product cost under eithermethod.

This analysis is designed to reveal the break-even point in production by determining how many products a company must manufacture and sell to reach the point of profitability. Similarly, period costs are essential for management accounting because they provide insights into a company’s performance. Period costs can include administrative expenses, marketing expenses, research and development expenses, and other overhead costs.