As the company’s cost accountant, the manager wants you to decide whether or not to accept this order. The integrated accounting system will calculate both cost components automatically so as to provide convenience to the accountant. In addition, this automated accounting system will also provide financial statements in real time and accurately. Manufacturing companies often struggle with choosing the right costing method for their operations. Wages can be considered a variable cost because they often fluctuate based on the amount of work needed. For that reason, we continuously develop products that can streamline business processes in all industrial sectors, no matter how big.

Disadvantages of Variable Costing

These are considerations that cost accountants must closely manage when using absorption costing. Absorption costing is not as well understood as variable costing because of its financial statement limitations. See the Strategic CFO forum on Absorption Cost Accounting that helps managers understand its uses to learn more. Even if a company chooses to use variable costing for in-house accounting purposes, it still has to calculate absorption costing to file taxes and issue other official reports. When it comes to measuring the cost of manufacturing processes, several methods can determine the cost of manufactured goods. Absorption costing also provides a more accurate accounting of net profitability, especially when a company doesn’t sell all of its products in the same accounting period in which they are manufactured.

Variable Cost vs. Fixed Cost: What’s the Difference?

It is now time to consider aggregated financial data and take into account shifting amounts of SG&A. On the left is the income statement prepared using the absorption costing method, and on the right is the same information using variable costing. For now, assume that Nepal sells all that it produces, resulting in no beginning or ending inventory. ABC costing assigns a proportion of overhead costs on the basis of the activities under the presumption that the activities drive the overhead costs. Instead of focusing on the overhead costs incurred by the product unit, these methods focus on assigning the fixed overhead costs to inventory. Because absorption costing defers costs, the ending inventory figure differs from that calculated using the variable costing method.

The purpose of period and product costs

While companies use absorption costing for their financial statements, many also use variable costing for decision-making. The Big Three auto companies made decisions based on absorption costing, and the result was the manufacturing of more vehicles than the market demanded. With absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the lower was the unit cost of that overhead.

How are fixed costs treated in cost accounting?

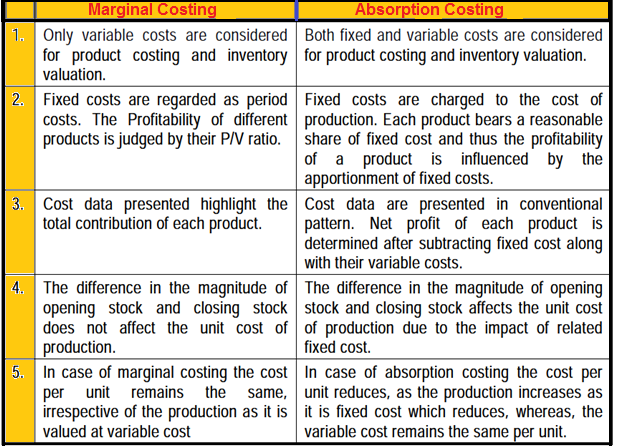

The treatment of fixed manufacturing overhead is the only difference between the two costing methods. All other product costs like direct materials and direct labor are treated the same. Absorption costing and variable costing are two different methods of costing that are used to calculate the cost of a product or service. While both methods are used to calculate the cost of a product, they differ in the types of costs that are included and the purposes for which they are used. The differences between absorption costing and variable costing lie in how fixed overhead costs are treated. In addition, the examples assumed that selling, general, and administrative costs were not impacted by specific actions.

Suitability for Cost-Volume-Profit Analysis

Under absorption costing, the fixed manufacturing overhead costs are included in the cost of a product as an indirect cost. These costs are not directly traceable to a specific product but are incurred in the process of manufacturing the product. In addition to the fixed manufacturing overhead costs, absorption costing also includes the variable manufacturing costs in the cost of a product. These costs are directly traceable to a specific product and include direct materials, direct labor, and variable overhead. Variable costing is a managerial accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in unit product costs. Fixed manufacturing overhead costs are treated as period costs and are deducted in full as an expense in the period incurred.

In straightforward terms, absorption costing is how the total cost of production comprises the direct costs of production and overhead costs. One of the big advantages of absorption costing is that it is the method required for a company to be in compliance with generally accepted accounting principles (GAAP). Even if a company decides to use variable costing in-house, it is required by law to use absorption costing in any external financial statements it publishes. Absorption costing is also the method that a company is required to use for calculating and filing its taxes. The fixed costs that differentiate variable and absorption costing are primarily overhead expenses, such as salaries and building leases, that do not change with changes in production levels.

- However valid the claims are in support of absorption costing, the method does suffer from some deficiencies as it relates to enabling sound management decisions.

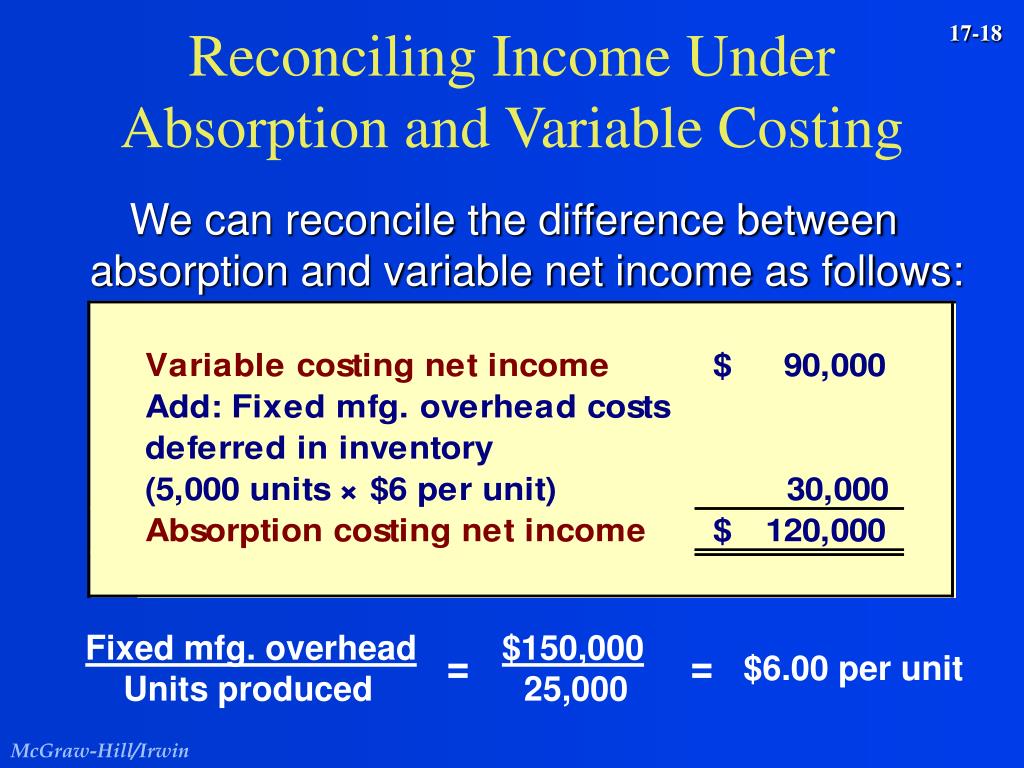

- As a general rule, relate the difference in netincome under absorption costing and variable costing to the changein inventories.

- Variable costing doesn’t add fixed overhead costs into the price of a product so it can give a clearer picture of costs.

- For example, a manager might decide to increase production even if there is no demand for the product simply because it will increase profit margins.

- Materials, such as raw materials and supplies, can also be considered variable costs.

No matter which method you choose, it’s essential to be aware of the strengths and weaknesses of each so that you can make the best decision for your business. Production is estimated to hold steady at \(5,000\) units per year, while sales estimates are projected to be \(5,000\) units in year \(1\); \(4,000\) units in year \(2\); and \(6,000\) in year \(3\). In summary, both methods have merits depending on business context and intended use. We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

By making informed decisions based on data-driven analysis, management can improve the profitability of their business and create long-term value for their shareholders. Absorption costing can be challenging to implement if you have a complex accounting system. Absorption costing means that ending inventory on the balance sheet is higher, while expenses on the income statement are lower. As such, absorption costing ensures proper inventory accounting and adheres to external reporting standards.

The other main difference is that only the absorption method is in accordance with GAAP. If the implementation of the two methods is still too complex, you can use the Accounting System from HashMicro. Net income on the two reports can be different if units produced do not equal units sold. Let us assume that the individual income tax forms total production units are 1000 and the cost card is as follows. Budgeting is the process of estimating the costs of a project or the expenses you expect to incur in the future. Finally, period costs can be volatile, meaning that they can vary significantly from month to month or even from quarter to quarter.